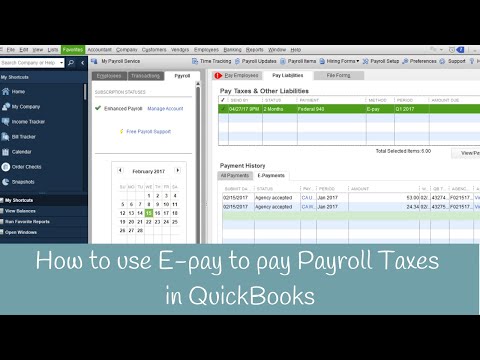

Hey, it's Candace. In today's QuickBooks tips and tricks, I want to show you guys how to set up IIPay for your payroll liabilities. In the past, I've showed you how to process and pay your payroll liabilities inside the IRS website. Some people prefer to choose the electronic method, while others prefer to pay it manually. It depends on your preferences. If you've already set it up in the previous way, I won't show you how to set it up with IIPay. To start, go under "Employee Payroll Taxes and Liabilities" and choose "Edit Payment Due Date/Methods." This will open up your payroll setup. Click "Continue." Keep in mind that you need an enhanced payroll within QuickBooks to use IIPay. Now, click on each type of payment you need to pay and click "Edit." For the 940 form, you need to pay until you reach $500. You can choose to pay quarterly or annually. You can also select a different payment type. I will choose quarterly and change it to IIPay. Previously, it was set to check while I was still learning about IIPay. Most of my clients prefer manual payments, so this is a new experience for me. Next, click on "Payment Method" and read about how e-payment works. You need to set up your items and payroll tax types as payments. I will show you how to do that now. Enter the necessary information for each payment type. So, how does the payment process work? QuickBooks sends the payment information to Intuit, and then Intuit submits the information to the agency along with other people's payments. The agency processes and accepts the payment, and then it is deducted from your account. Intuit does not access or hold the funds during the IIPay transaction. The agency updates the...

Award-winning PDF software

De9 2025 Form: What You Should Know

Online EDD Forms · DR Forms Online Employment Relations, Compensation, Pension, and Leave Plans · W-4 Forms — EDD, IRS, ADP (and related forms) California Wage & Hour Division W&H Forms California Wage & Hour Division (WHO) Unemployment Insurance and Related Records Check the box when completing the online EDD Employment Tax Return of Employment, Social Security, and Tax Returns form to indicate if you have any federal unemployment compensation. California wage and hour laws provide for filing the federal unemployment insurance form, as a California resident, using EDD Form 5073, the Federal Form. The information on form 5073 must be checked on the W&H form. If you have federal unemployment compensation, you should complete this form to verify that. Pay Your State Unemployment Insurance Taxes In California The California Unemployment Insurance Division (DOTER, Division of Benefits) administers the State Unemployment Insurance (UI) program to provide unemployment insurance benefits in California. As a general rule, you are required to pay your state unemployment insurance taxes in California. However, the California Unemployment Insurance Division (DOTER), Division of Benefits, will send you a bill if you do not pay your federal/state wages, unemployment insurance taxes and employment tax taxes (ESTA tax) to the state of California. How do I pay my California Unemployment Insurance (UI) tax in California? Pay your state unemployment insurance (UI) taxes in California now! You can start today! To pay your 8.27 State Unemployment Insurance tax to the state of California, write: California Unemployment Insurance Tax Bill Please submit the payment by mail. You will have 60 days after any payment is received to file or pay the state Unemployment Insurance tax. You will have 60 days after any payment is received to file or pay the Federal Unemployment Tax (FTA) and Social Security wage earnings taxes. Filing the State Unemployment Insurance Income Tax Return As you continue to earn state unemployment insurance (UI) benefits, you are required to file a tax return or report your payments to the state of California. The tax return for each month of earnings must be filed or reported in addition to the Federal tax return. You must file an income tax return if your wage earnings exceed 1,100.00 per month. You must file a tax return if you are self-employed.

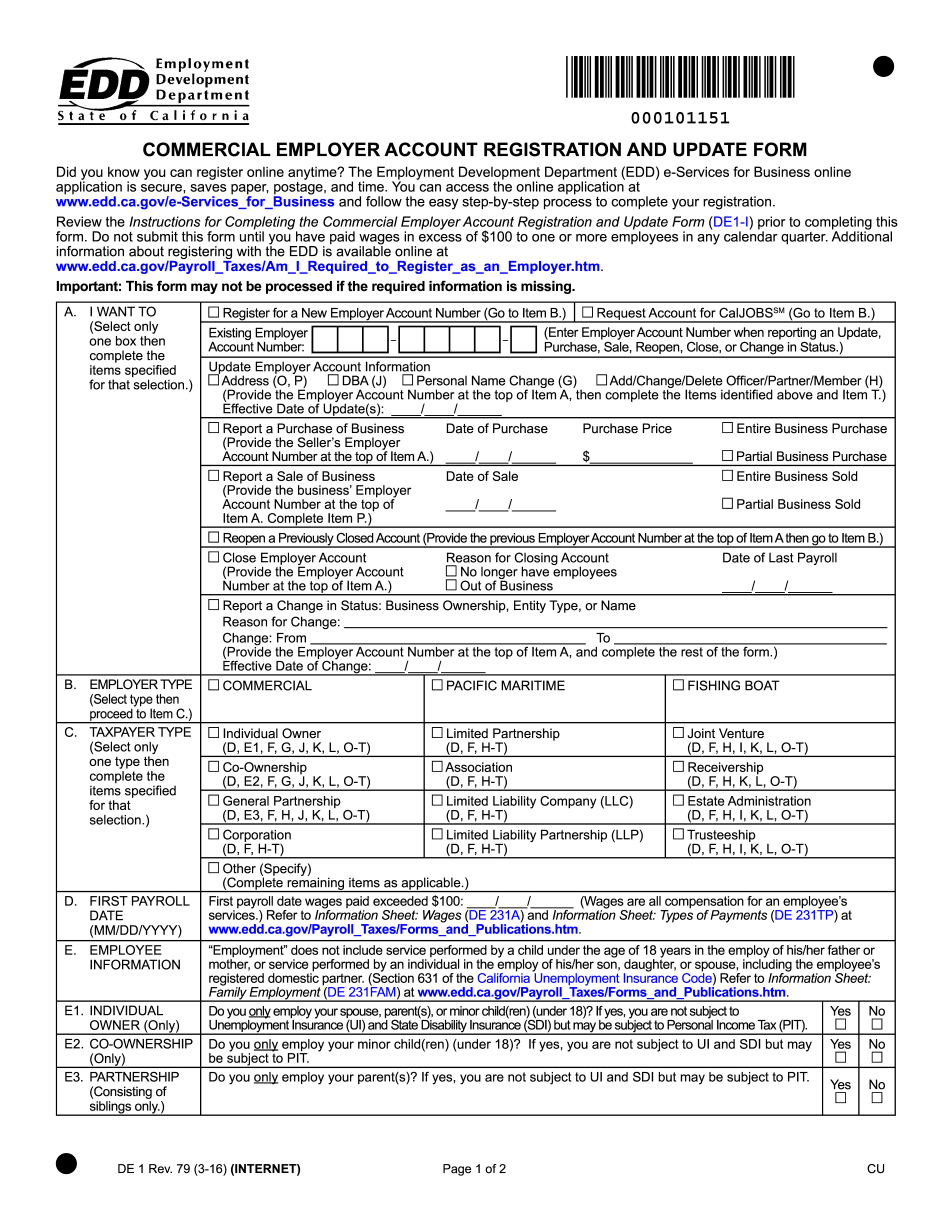

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing De9 form 2025