The California Employment Development Department (EDD) developed this tutorial to assist you with navigating through eServices for business. Here is a list of tax returns and wage reports you can file using eServices for business. This tutorial will show you how to file a quarterly contribution return and report of wages (DE9) and a quarterly contribution return and report of wages continuation (DE9C) for an employment tax account. It can be used as a guide when filing other tax returns and wage reports on eServices for business. This is the eServices for business homepage. Select the employment tax link for the account for which you would like to file the tax return or wage report. This is the account home page. Select the period for which you would like to file the tax return or wage report. For this example, we select March 31, 2018. This page displays all alerts and activity for the period we just selected. Select the "File or Adjust a Return or Wage Report" link from the menu. Select "File Now" next to the tax return. Answer yes or no to the question, "Do you have payroll to report?" For this example, we select yes. Select "Next" to continue. Select the "Instructions" link for assistance if needed. When the information is completed, select "Next". You must complete the declaration page. On this page, you declare that the information provided is true and correct. When the information is completed, select "Submit". Confirm if you want to submit this request and select "OK" to continue. Here is your confirmation number for the form you completed. You can print a copy for your records and select "OK" to continue. Select "File Now". Answer yes or no to the question, "Do you have payroll to report?" For this example, we select yes. Select "Next"...

Award-winning PDF software

De 9c 2025 Form: What You Should Know

Certification Form or Forms (9C). Please check if you have imported the correct form from your account. The California DE 9C Form is an employer's responsibility, and this form is not an agency form, which will appear on your federal tax return because the California DE 9C Form has already been filed by your company in any state, and not by the California Department of Employment Development (EDD) or any other state agency. For this form the DE 9C Form contains information from California employer. This form is required by the California Department of Employment Development (EDD) to ensure that employers comply with the Employment Development Tax Act, also known as the Wage Garnishment Law. If there are not enough payroll checks in your bank by the end of the quarter, you must file a Report to Correct Earnings (REC) (9C), and pay state income tax, based on the amount withheld, for the preceding quarter. In California, the Quarterly Contribution Return and Report of Wages (DE 9C) is a report of California contribution tax paid by an employer. The information you provide is based on data from a tax record at a federal, state, or local tax return, or from an employer's internal records or records obtained directly from its employee(s) by the employer. Payroll Taxes — Forms and Publications — EDD — CA.gov The Employment Development Department (EDD) in California is responsible for collecting all California Department of Employment Development wages, and filing the Quarterly Contribution Report (DE 9C) electronically from an employer of each quarter. Employers must file their Quarterly Contribution Report (DE 9C) quarterly. For a quarter, in order for the reports to calculate correctly, you will need to have payroll receipts from the preceding quarter. The quarterly contributions are due at the end of the quarter. The quarterly contributions report must be filed before the employer's payroll checks are distributed to employees on April 15th, May 15th, July 15th, September 15th, or December 15th. Employers should keep a copy of the report for 30 days. You should also file electronic Form 1544 with your state's employment tax office for each quarter, and report your receipts of all quarterly contributions, by the end of the calendar quarter.

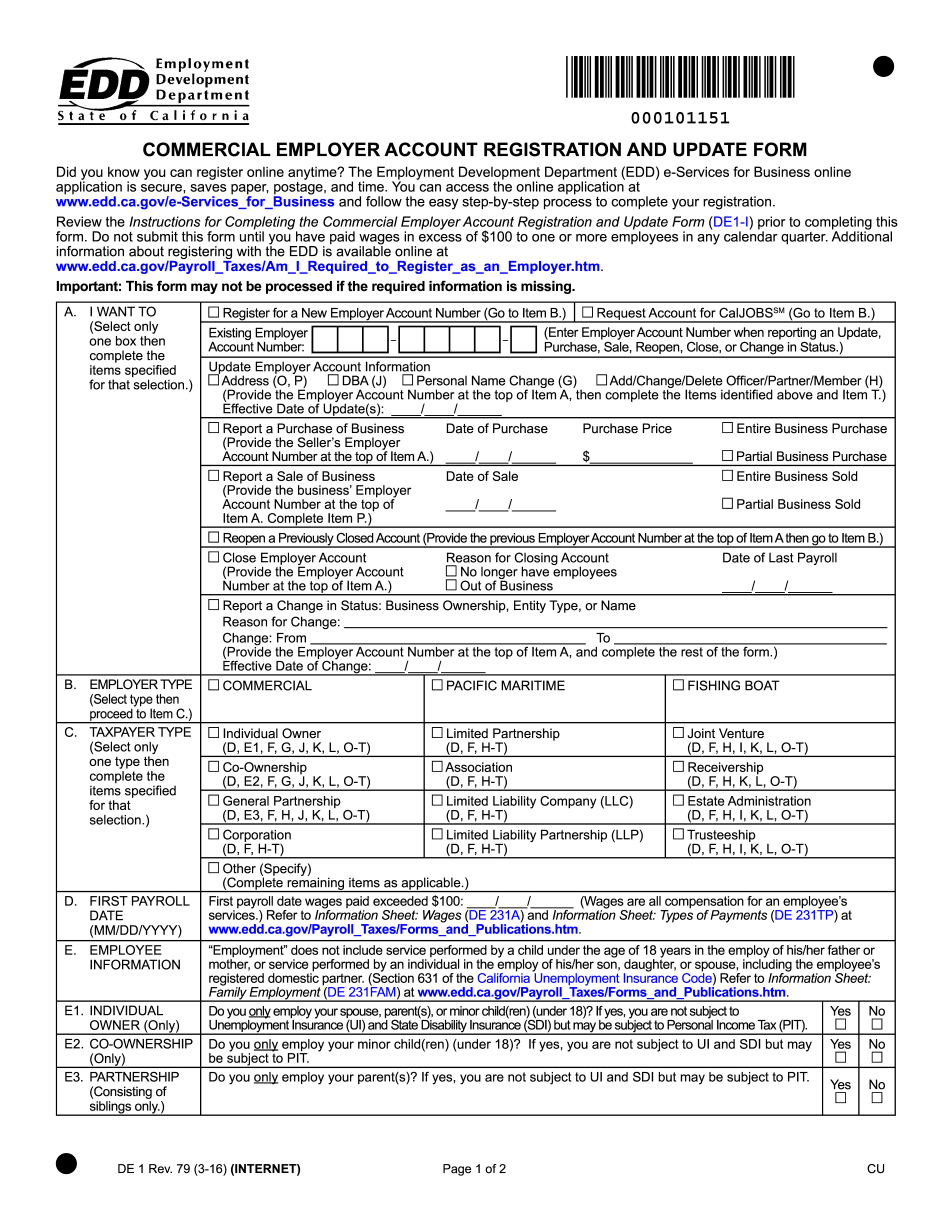

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing De 9c form 2025