When you're starting to ship internationally with UPS, getting customs documentation right is the key to a smooth experience. We have a guided process to make it easier. A commercial invoice is the most crucial form. It's required for all international non-document shipments and is used by customs to calculate duties and taxes. As soon as you click ship on UPS.com, our guided shipping option automatically helps fill in the info you need for all your forms. Alternatively, you can print and fill them out yourself. You'll need a clear description of goods. Be as specific as possible. Instead of just saying "apparel," provide more details like "36 pairs of merino wool hiking socks." Note where the goods originated, which is often where they were manufactured. Include the value of each unit and the shipment as a whole. Don't forget to mention the reason for the export. If you're using printed commercial invoices, make sure to include three signed copies with your package. UPS is here to help at UPS.com/international.

Award-winning PDF software

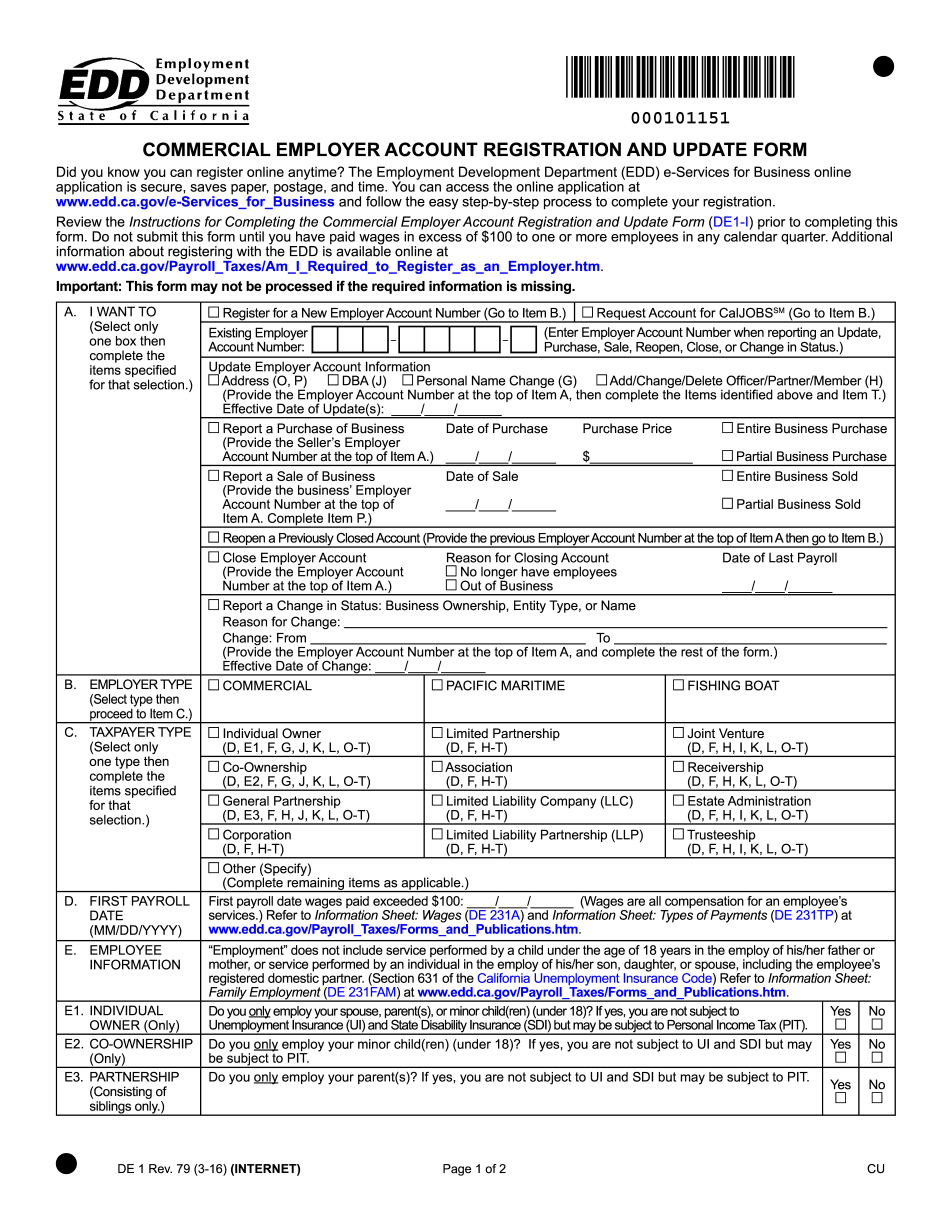

What is a commercial employer Form: What You Should Know

You must have a name on Employment Department employee list. Downloaded to your computer/web browser Step 2: Download and read EDD Employee List PDF or Word document Step 3: Complete DE1-I (Form). (PDF) Step 4: Print out & save EDD Employee List PDF or Word document Step 5: Create Your Account. Create your account online (Online Registration), by mail (Employment Department). Complete this form .pdf Step 6: Mail completed form (PDF or Word File) Once you are registered you will be billed as follows: If your account falls under EDD services — 75.00 (for first month). If your account falls within Business Improvement Area (BIA) — 100.00 (first two pay dates after the month registration), plus the 1.25% tax (fees for each month thereafter). If your account falls under Business Improvement Areas (BIA) or not in EDD Services but is otherwise in good standing (will not fail to pay in 1 or more of the 3 years) — 75.00 (for each calendar year). For Business Improvement Area (BIA) and previously registered accounts the first 2.5% tax (fees for each month thereafter). Note: The 1.25% tax (fees for each month thereafter) will not be charged the first year of your account if your account had no payments to begin with. If your account fails to pay all taxes due in the month you are required but still in good standing, you will be charged the 1.25% tax (fees for each month thereafter); otherwise your money will be frozen. Note: If your account fails to pay all taxes due in the month you are required but still in good standing, you will be charged the 1.25% tax (fees for each calendar year); otherwise your money will be frozen. If your account fails to pay all taxes within the calendar year, EDD will be compelled to suspend your account for up to 13 months at a time, and you must pay the additional taxes out of pocket.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is a commercial employer