The California Employment Development Department EDD developed this tutorial to assist you with navigating through eServices for business this tutorial will show you how to file a report of independent contractors de 542 and a report of new employees de 34 we will begin at the eServices for business homepage select the employment tax link select the show all link next to the i-12 menu select the file report of independent contractors link this opens a new tab this box is here to inform you that you are leaving eServices for business select continue to IIC our page to continue select create new de 542 enter service recipient information here when completed select next enter the independent contractor information on this page when completed scroll down to the bottom of the page at the bottom of the page select next the information you entered is now saved if the information is correct select submit to send this request here you can see that the submission was successful a printer-friendly version is available here close the tab to go back to the eServices for business home page to report newly hired employees select the employment tax link to go to the account for which you want to file a report of new employees de 34 select the show all link next to the i-12 menu select the file report of new employees link this opens a new tab this box is here to inform you that you are leaving eServices for business select continue to I in ER page to continue select create new de 34 enter your employer information on this page when completed select next enter new employee information on this page when completed scroll down to the bottom of the page at the bottom of the page select...

Award-winning PDF software

Edd employer services phone number Form: What You Should Know

Information for Employees & Employers — EDD — CA.gov Tax Forms, Publications and other resources for employers and employees, both English: Spanish: [8:00 AM — 4:00 PM EST] Disability Insurance · English: · Spanish: · California Relay Service (711): Provide the DI number () to the operator Disability Insurance Help for workers in California. Disability insurance is a benefit for individuals who have a physical or mental impairment which, as a result of work-related activities, substantially limits one or more major life activities. Under current law, employees may also be eligible for Disability Insurance coverage under certain circumstances. This program is sponsored by individual companies and is administered through a state agency. Employer's Liability Insurance · English: · Spanish: · California Relay Service (711): Provide the DI number () to the operator (you must have an insurance carrier) Disability Insurance · English: · Spanish: · Information for Employees & Employers — EDD — CA.gov Information regarding the benefits and coverage of Disability Insurance may be obtained from the California Department of Insurance. The state Agency for Insurance Regulation (California Department of Insurance) can be reached at:, Ext. 2201. Employer's Liability Insurance · English: · Spanish: · California Relay Service (711): Provide the DI number () to the operator (you must have an insurance carrier) Employer's Liability Insurance · English: · Spanish: · Information for Employees & Employers — EDD — CA.gov Information regarding the benefits and coverage of Disability Insurance may be obtained from the California Department of Insurance. The state Agency for Insurance Regulation (California Department of Insurance) can be reached at:, Ext. 2201.

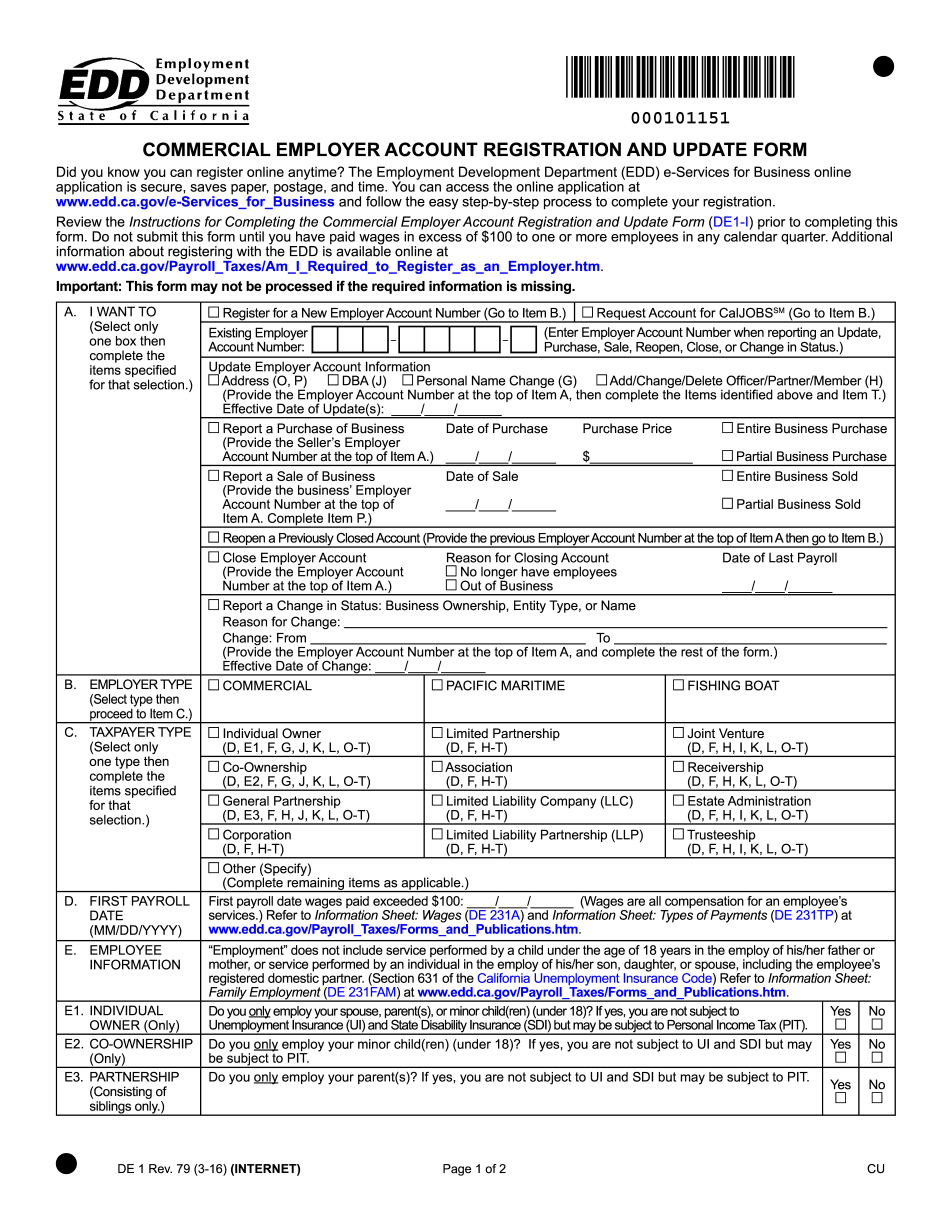

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Edd employer services phone number