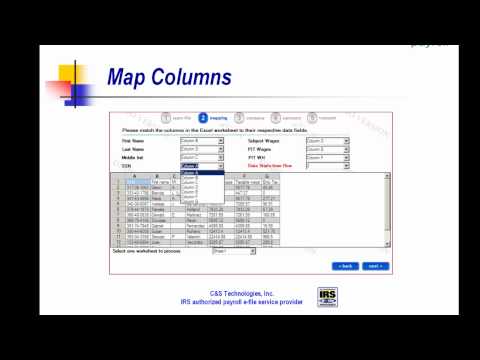

California employers are required to file forms DNI and Dean I see quarterly d 34 and D 542 is needed to the EDD East. My payroll offers a unique track filing solution for businesses and payroll professionals. There are currently seven approved Etha providers for F set federal state combined employment tax filing to California EDD. East my payroll is the only one that provides a standalone dedicated window direct filing software. The required filing is 100% private because data is transmitted from your desktop to the EDD server directly. Our Windows software also accepts legacy data files in mm, our EF, or I see ESA format. The Windows software transmits all four of the EDD forms prepared individually or uploaded in Excel or dot txt files. You can download the software from our website and start transmitting test files to EDD servers immediately in the demo mode. If you're happy with the results, you can then purchase a license to transmit live data to EDD in the production mode. Let's transmit a test file of the in ic to the EDD server. Select the file format as an Excel file and browse to your test file. Map the data columns to the respective data fields on a te nicey. The Excel worksheet has seven columns: SSN, first name, middle initial, last name, subject wage, PID wage, and tax withholdings. Enter the tax year, water company information, and employee counts. Review the summary, check the wage totals, etc. Then send the data to the EDD through the internet. Since we're using the demo mode, the data is sent to the EDD test server and will not be processed by the EDD. EDD will return a confirmation after the file is successfully transmitted and received. It's as simple as that. Your...

Award-winning PDF software

Edd efile Form: What You Should Know

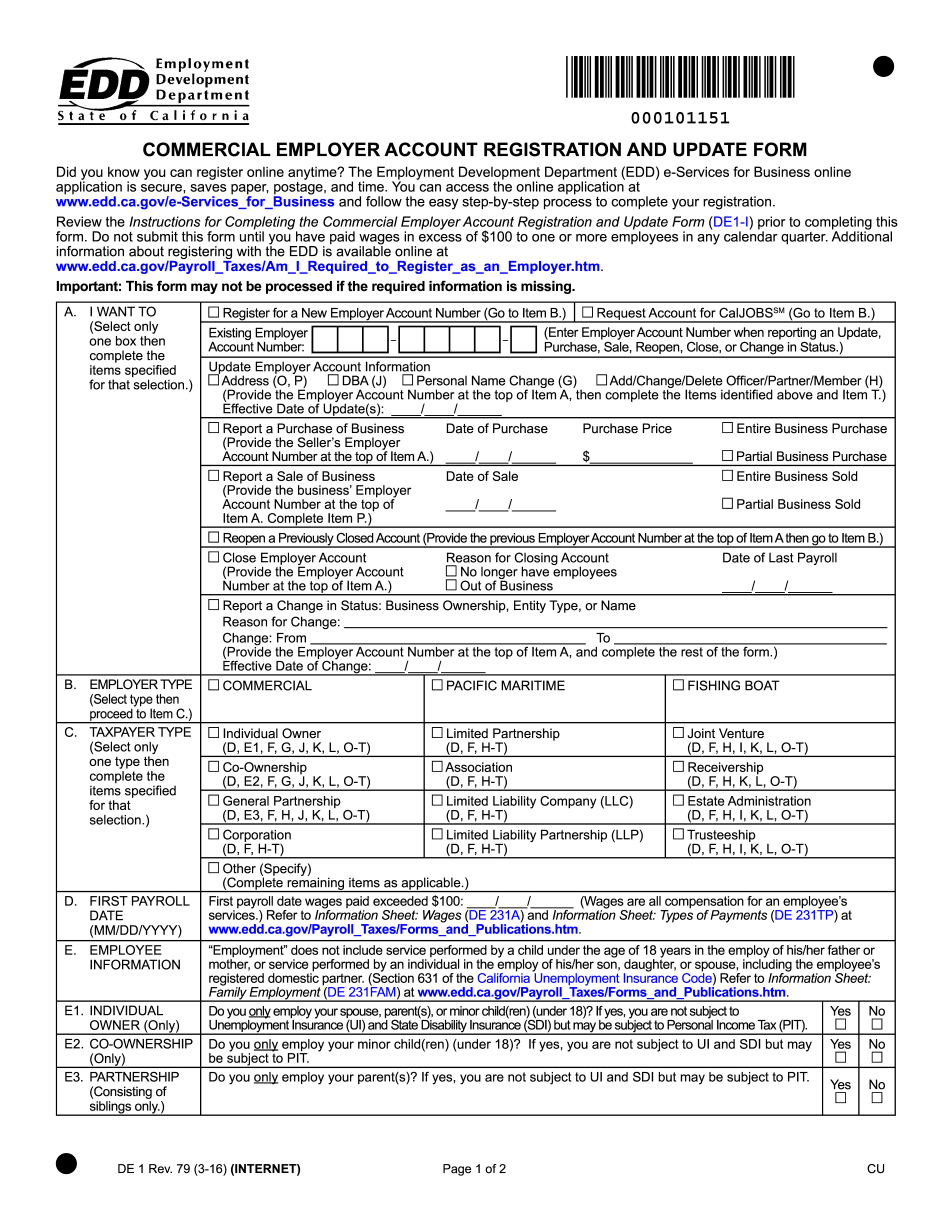

Tax to the California Employment Development Department (EDD) electronically to comply with AB 125, California Government Code, Section 8125, effective January 1, 2017, which requires employers to pay all employment taxes on wages paid to employees in California as a result of federal income tax withholding and tax reporting regulations under 26 USC Section 4980H. A. An employer's e-file and e-pay mandate (e-file and e-pay man datum for employers) will impose additional requirements on the employer, in particular, it will require the employer to submit certain information in a manner prescribed by the Director as the e-pay and e-pay mandate requires the e-file and e-pay mandate for California employers to electronically report and transmit employment tax information to the EDD. B. An employer's e-file and e-pay mandate (e-file man datum for employers) will waive the requirement for employees to file and pay federal, state and local income taxes (8.25% withholding) with respect to federal and state unemployment tax withholding requirements set forth in 27 U.S.C. §§ (b) and (c). E. In addition, an employee will be exempt from paying federal, state and local employment taxes upon receipt of an Employee Income Tax Deduction Certificate (ETC), for purposes of the entire 8.25% Employment Tax on wages, effective Jan. 1, 2017. F. The EDD will maintain a record of the amount of each individual's annual electronic filing and pay requirements to verify compliance for an employer and employee. G. EDD has issued, by rule or regulation, a prescribed schedule (prepared by the Commissioner) which identifies certain information required to be prepared by employers or employees when preparing Form W-2 for the benefit of an Internal Revenue Determination issued on January 31, 2018. H. EDD anticipates that the Department of Finance will, by fall 2018, create a unified filing system for wage and employment tax returns and other electronic reports to support federal and state payment obligations when the e-file and e-pay mandates become effective. K.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Edd efile