So in this video, I want to teach you guys how to update your California taxes for QuickBooks Online. The state unemployment rate and the ETT training tax change every year, and the EDD will send you a form towards the end of the year. This form takes effect starting on January 1st of every year. Intuit updates your payroll taxes based on the state rates, but the state of California does not base its rates on everyone. It depends on your fund, how much you've paid in, and how much unemployment you've received from your employees. Each employer may have different rates. To update your taxes, go to taxes in QuickBooks and click on "Edit Your Tax Setup." You will need to have the form mailed to you by the EDD, which has your state unemployment rate, ETT training tax rate, and SDI (which is the same for everyone). Once you have the form, click on "Edit Your Tax Setup" and go to "State Tax Information." Your rate may or may not change, but you need to enter your EDD number and your current rate. You can also change your deposit schedule. The unemployment rate is listed here, and if it has changed, you can click on "Change or Add New Rate" to update it. For example, in this QuickBooks file, the unemployment rate was 5.4 in 2016 and 3.4 in 2017. However, the current rate did not change and is still 3.4 for this particular company. The same is true for the ETT training tax, which is still 0.1. Note that if your unemployment rate is high, you may not have any ETT employer training taxes. If you are using the desktop version of QuickBooks, there is a link provided above to track how to update your taxes....

Award-winning PDF software

California unemployment tax login Form: What You Should Know

Forms for Individuals, Employers, and Businesses and FAQs — Tax Publications for Individuals and Employers. Online Employment and Workers' Compensation Information (EDDY) — EDD — CA.gov See what employers pay you or who benefits from your workers' compensation claim. The Unemployment Insurance Eligibility Center provides these details, which you must understand before you fill out any other unemployment insurance claim. If you do not understand the eligibility requirements for another type of unemployment insurance claim, click Here to obtain the following information: Online Claim Review (PDF) — EDD — CA.gov Income Tax Information (Form 1040) — EDD — CA.gov Payroll Taxes — Forms and Publications — EDD — CA.gov Online Unemployment Insurance Claim Review (PDF) — EDD — CA.gov Your claim should be reviewed to determine if the conditions outlined on this page apply to the basis of your claim. Unemployment Insurance Eligibility — EDD — CA.gov See what you need to know about filing with the Unemployment Insurance Eligibility Center If you qualify for benefits, you will pay premiums and receive unemployment insurance for the number of days you were out of work. If you were working during your eligibility period, you may still be eligible for benefits. However, you may choose to not pay the premium and file an appeal. Unemployment insurance is an essential tool to help people who lose their jobs or their economic security. A full-time worker who loses his or her job may qualify for Social Security. But if the worker is self-employed or owns a business, that individual will be denied any unemployment benefits. You may receive unemployment insurance if you voluntarily quit your job for several qualifying reasons.

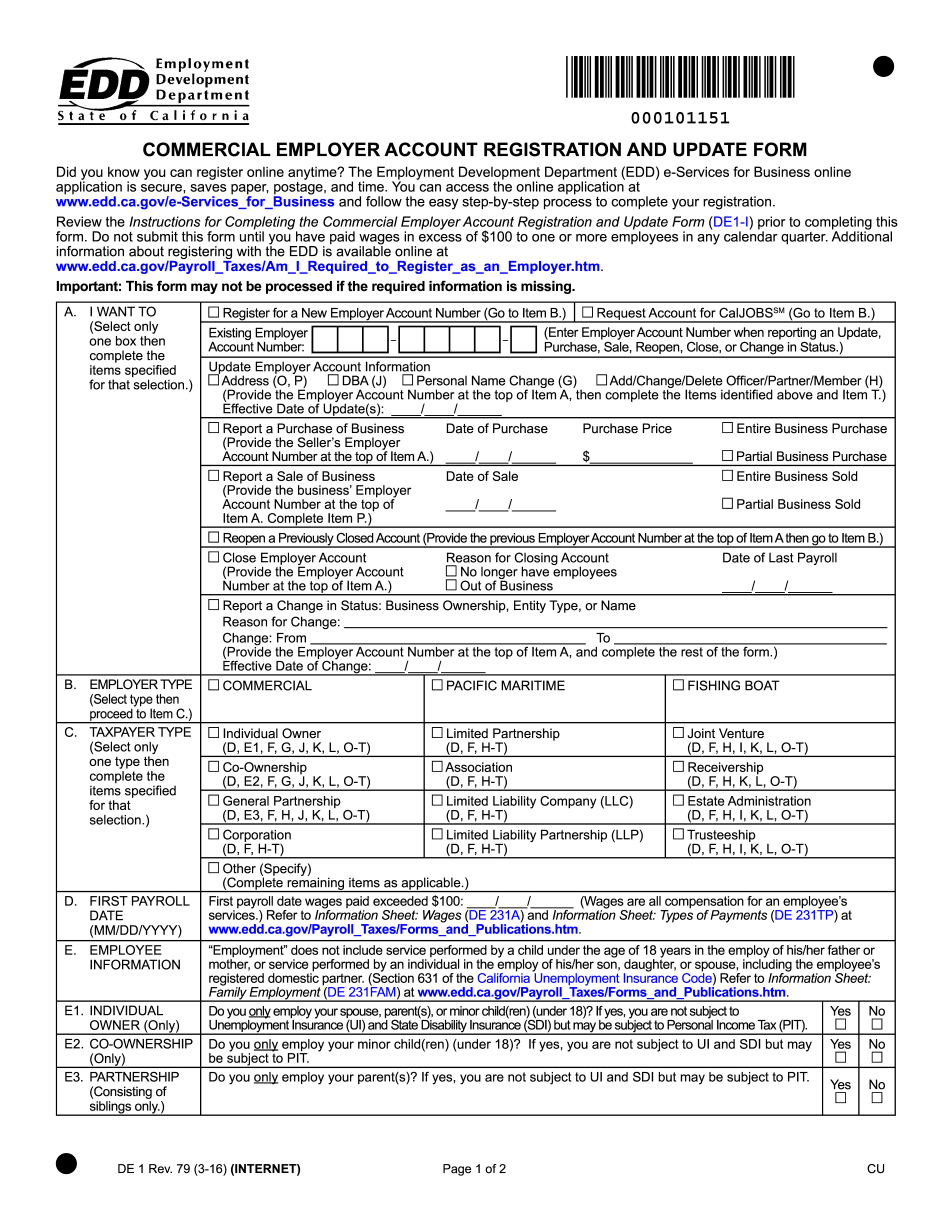

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing California unemployment tax login