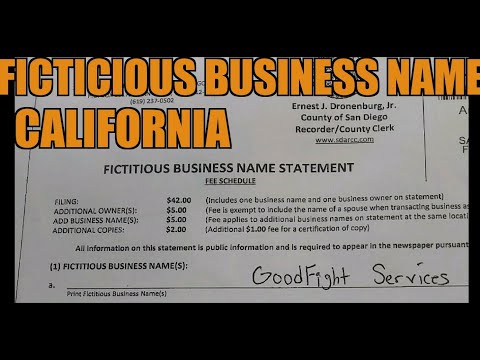

We're here at the San Diego County Recorder County Clerk, ready to take care of the DBA (doing business as) registration for our fictitious business name. The plan is to pay $42 and get things done correctly. Oh man, here it is, the fictitious business name document. Sir, the fight against the good fight services has begun. Alright, I'm back at headquarters, and I have some information to share with you. These are the necessary steps to legally establish a business. Let me read some of them to you. I went to register my doing business as my fictitious business name as "Good Fight Services LLC" (limited liability company) since it provides personal protection. If sued, they can only go after business assets unless there's a breach. So, that's what I wanted to go for. However, they informed me that I can't register the DBA as an LLC since I haven't formed and submitted my LLC to the secretary of state yet. They advised me to register it as an individual for now. I asked about making changes later when my LLC is registered, but they said I would have to pay $42 again and republish the name. I thought about it and realized I don't want anyone to take my name, so I decided to proceed with the individual registration.

Award-winning PDF software

Business address change california Form: What You Should Know

All the following requirements must be met to change your business address: 1. The name on your California Certificate of Incorporation needs to change, the business name must be the business name you are filing for (business entity). 2. If the business does not already have a California Certificate of Incorporation, you will need a California Limited Liability Company Name Change Form, and if it already has a California Limited Liability Company, you will need a Change of Name Form. A California LLC changing its name and business address is no different from filing an amended certificate of incorporation for the corporation. However, this form is used only on the LLC. (Note: Form 8822-B and other forms mentioned above also must be filed with the LLC.) Please note : You will be provided the name and phone number of your FTTB. Do not call to change your business address. What if I need to file both an individual form 3533 and a corporation form 3533? Individual Form 3533 is intended to be filed with the corporation and with this form, you change the name of the corporation. Individual Form 3533 must also be filed with the entity's Certificate of Incorporation if: 1. The LLC will operate a corporate-type business or 2. It is a tax deferred class-A corporation for federal income tax purposes. Corporate Form 3533 must be filed with the corporation only if the entity will be listed as a partnership or joint venture. These forms are not required for sole proprietorship. These forms must be filed with C-6 or C-12 if you are a sole proprietor, or they must be filed C-7 or C-9 if you are incorporated as an S corporation. All other entity forms are not required for filing C-7 or C-9 forms. How do I change my address if more than two people own the LLC, and only one of us is the owner of the LLC? All the following requirements must be met to change your business address. 1. All the other owners are required to complete and file FT 3533 as their own individual form. (Note: Form 8822-B and other forms mentioned above also must be filed with the LLC.) 2.

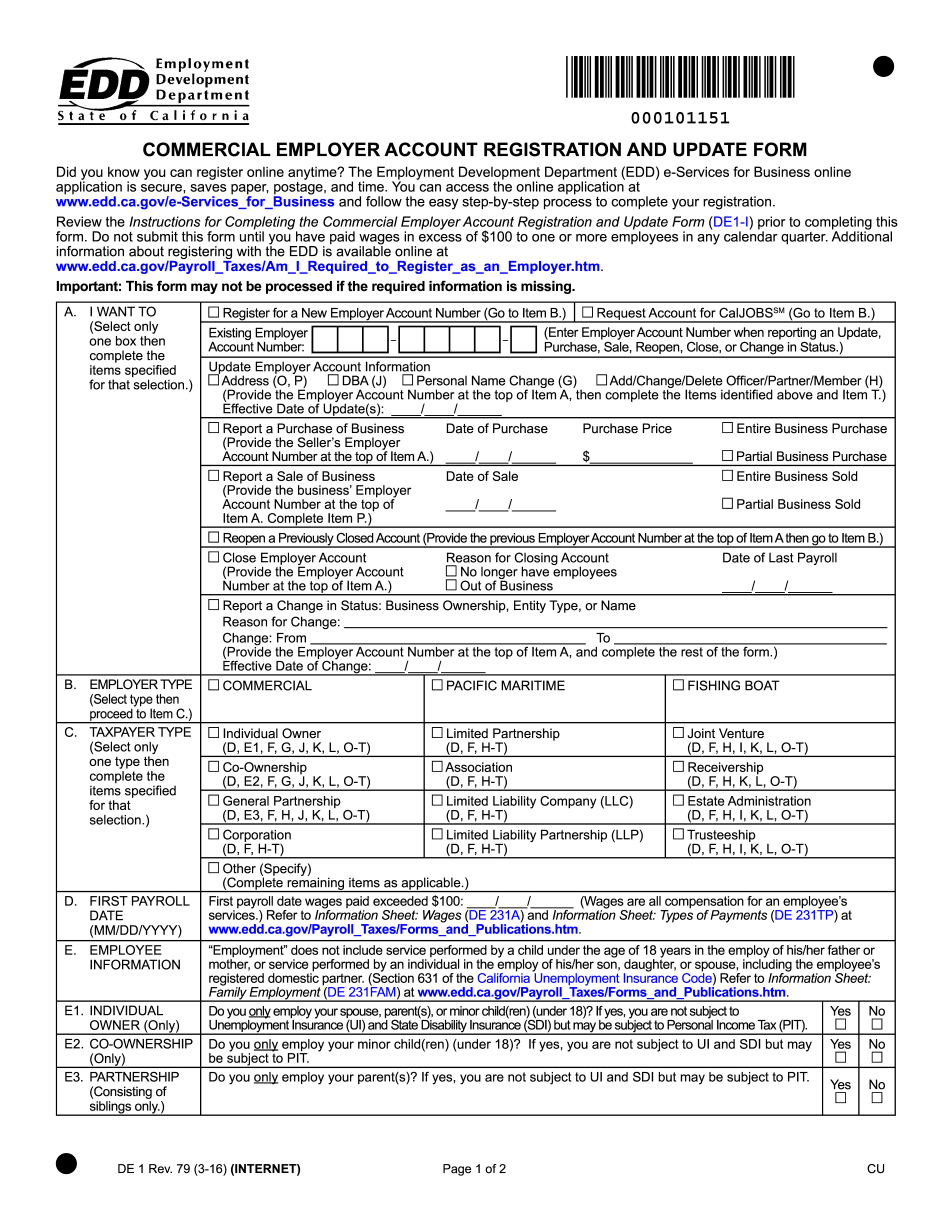

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Business address change california