The California Employment Development Department (EDD) developed this tutorial to assist you with navigating through eServices for business tax returns and wage reports. Corrections need to be made in order to adjust a quarterly contribution return and report of wages (DE9), as well as a quarterly contribution return report of wages continuation (DE9C) for an employment tax account. This tutorial can also be used as a guide when filing other tax returns and wage reports. The process begins at the eServices for business homepage, where you select the employment tax link for the account you wish to adjust. From there, you select the period link for the specific period you want to adjust, such as December 31, 2017. On this page, you can view any alerts and activity related to the selected period. To adjust the tax return or wage report, select the file or adjust a return or wage report link from the i-12 menu, and then select the view or adjust return link next to the tax return. Here, you can see information about the tax return, including when it was filed and the status of the request. Select adjust return and answer yes or no to the question regarding payroll reporting. For this demonstration, we will select yes. Select next to continue. On the next page, you will find the previously filed tax return with pre-populated figures. You can edit fields such as total subject wages paid this quarter, UI wages, SDI wages, SDI contribution, personal income tax withheld, and less contributions and withholdings paid for the quarter. Complete the form with your new wage and contribution information, and then select next to continue. The reason for adjustment field is required, so enter your reason for adjusting the tax return and select next to continue. You must...

Award-winning PDF software

Edd s de9 Form: What You Should Know

File electronically using E-Services Required Filings and Due Dates — EDD — CA.gov Required to File– EDD — CA.gov Online Form– EDD — CA.gov If the employer reported and remitted correct wages by the due date then the employer must furnish the required reporting information. Required Filings — E-Determinations for the E-Dollar Wage Report Electronic Reporting Required — EDD — CA.gov Online Forms — Electronic Employee Wage Report (SALES) Electronic Reporting Required — EDD — CA.gov Online Forms — Quarterly Contribution Report and Report of Wages (DE 9) Electronic Returns to the E-Dollar Wage Report (DE 9) Electronic Forms for Wage Deduction Tax Returns— EDD — CA.gov Employer Reporting (E-Dollar Wage Report) (ESC) Electronic Reporting required — EDD — CA.gov Online Forms — Quarterly Contribution Return and Report of Wages (DE 9) Electronic Forms for Wage Deduction Tax Returns— EDD — CA.gov Employee Wages and Benefits and Related Forms (E-Dollar Wage Report) (ESC) — EDD Electronic Contribution Report and Report. If the employee report is incorrect, use EDD's e-Services. EDD's online reporting of EDD Form W-2 (employee withholding and tax) Electronic Employer Reporting (E-Dollar Wage Report) (ESC) (E-Dollar Wage Report) (ESC) If an employee report is incorrect, use EDS's e-Services.

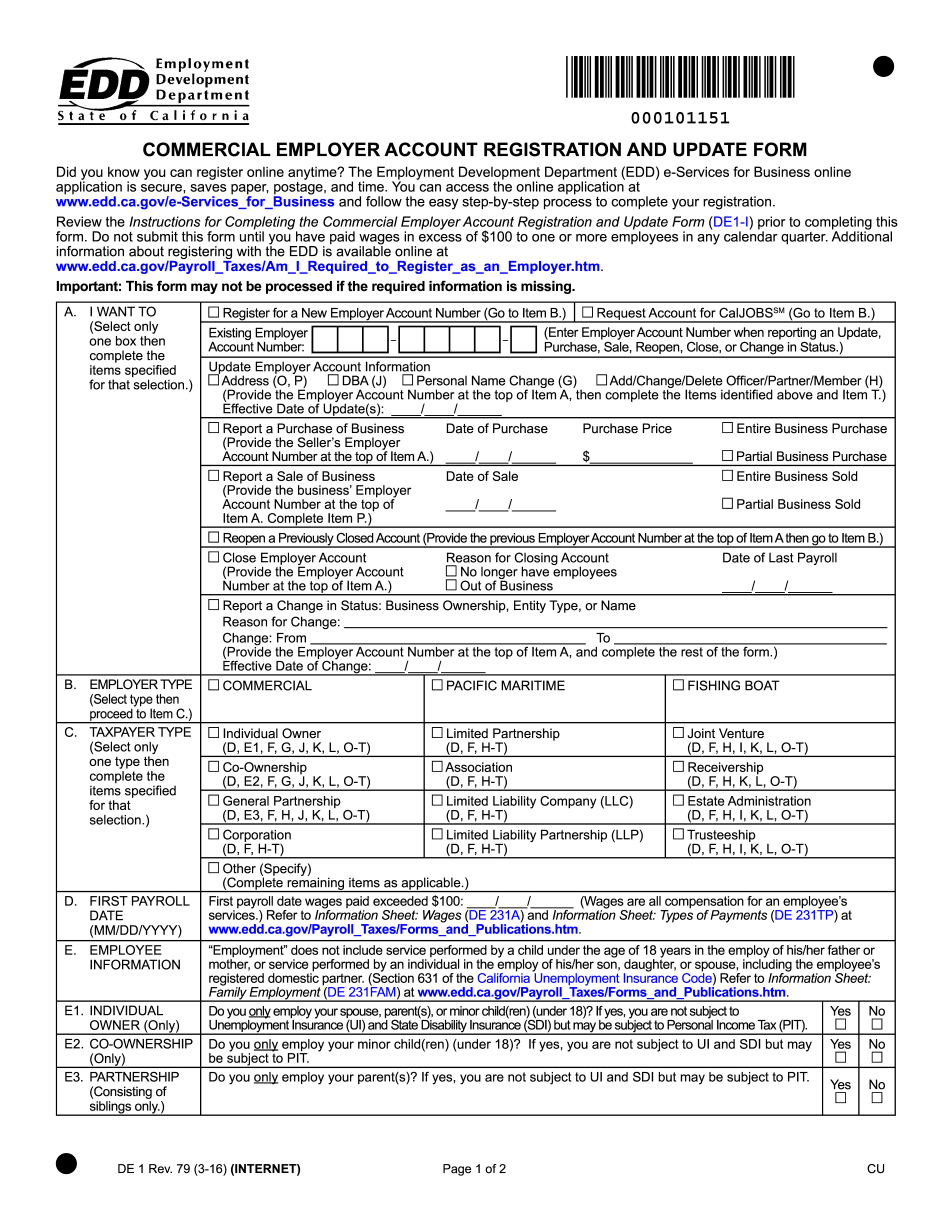

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Edd Forms de9