Award-winning PDF software

De 9c Form: What You Should Know

Report of Wages and Information for Employment-based Assistance. This program is administered by the Employment Development Department (EDD) (Cal. Employment and Labor Code sections 6254(a).) For more information, read the summary California Wage Reporting Requirements.” Employee Compensation Information Disclosure The information in this module on employee compensation reflects information from the federal Fair Labor Standards Act of 1938, or FLEA of 1938 (section 20-c); or the California Fair Employment and Housing Act (Cal. EH. Code sec. 3299 et seq.) See the list of FLEA Provisions for details on the disclosures required by each of these laws. California also has an exemption for employees receiving benefits provided by an employee organization. See the list of Cal. Fair Labor Standards Act Provisions for details on the exemptions in Cal. EH. Code Sec. 3253. When an employee receives additional compensation, the report of salaries and wages must include the number of weeks an employee receives the additional compensation and the amount received in excess of the normal wages for each calendar week. These include paid vacation, tips and commissions. You may have additional information in your records or may need a correction to the information in the report. Call the Employment Development Department at, the county office by calling, or the county Human Resources Division by calling. This information applies to the California Employment Development Department, California Department of Industrial Relations, California Department of Finance and other local governments (local governments) in the following counties: Alameda, Marin, Los Angeles, San Francisco, Santa Barbara, Santa Clara, Alameda, Sacramento, San Diego and Ventura. Cal. EH. Code Sec. 1091 These provisions are intended to apply to all employees engaged in employment that requires payment of the regular hourly wage rate of at least 12.00 an hour and that meets the requirements of federal, state or local law. (This includes employees of employers located within local government, regardless of whether the employee is currently engaged in employment with that local government.) Where a local employment law conflict occurs, the law of the jurisdiction where the employee provides services determines the applicability of these provisions. See the list of Federal Fair Labor Standards Act Provisions for details on the exemptions in Cal. EH. Code Sec. 1091(a.) See Secs.

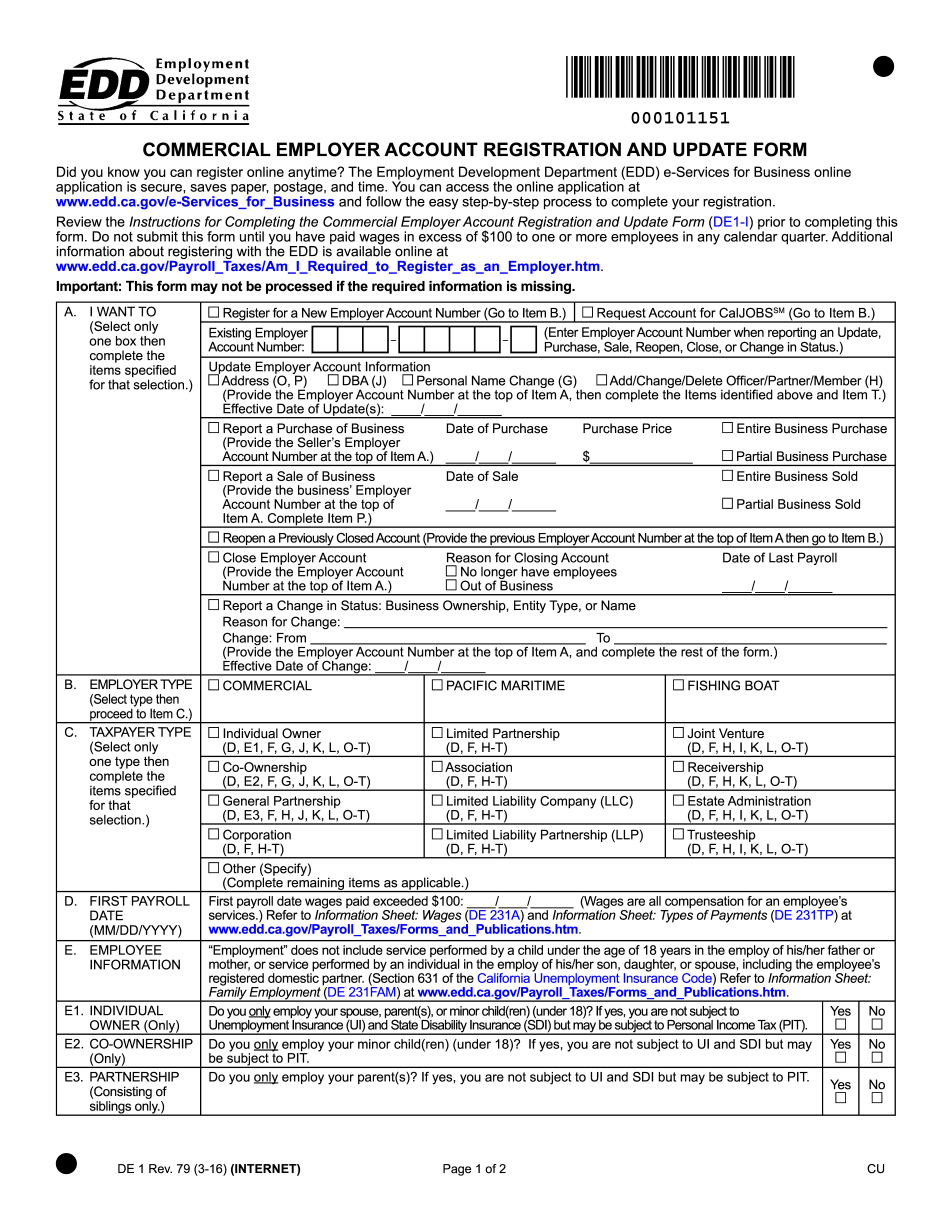

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form De 1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form De 1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form De 1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form De 1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.