Award-winning PDF software

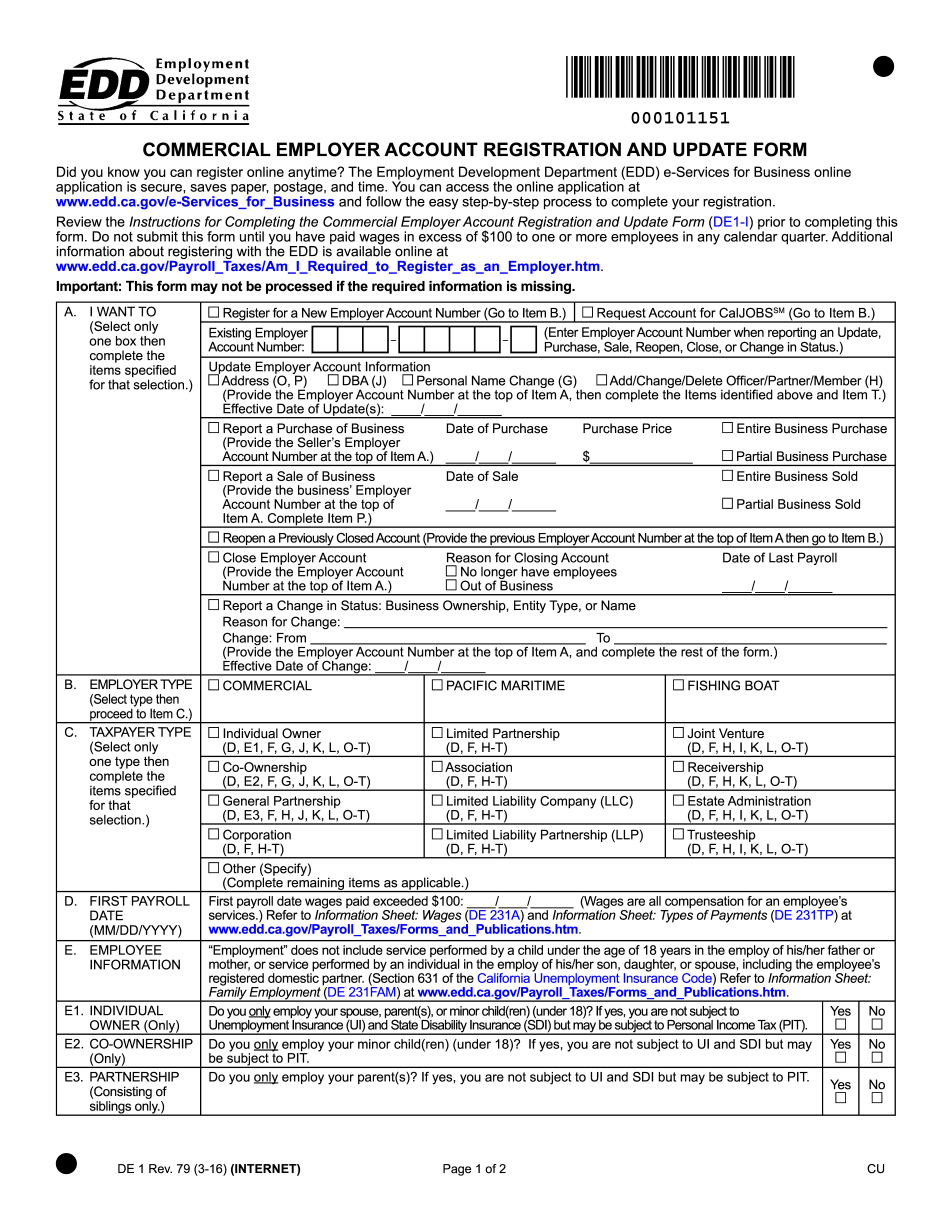

commercial employer account registration and update form (de 1)

What will I see on the Commercial Employer Account Registration and Update Form (DE1-I)? You will first see the following: Date Type of Account Date opened Current Account Balance Account Type for Current Month Date closed Account Closing Date Account Expiration Date What is my business number? Your business identification number (BIN) is the 12-digit number from the following list: Business Number If you are self-employed, your BIN is the BIN number from the following list: Business Number of Business Number Enter either your BIN or business number, depending on your account type. If you are selling and paying employees, enter your employees' BIN numbers: Employee's BIN for Enter Employee Number of Employee Employee's BIN for Enter Employee Number of Employee If your business is a sole proprietorship, enter the business name: Entrant name Entrant type Enter the legal residence of the proprietor on the appropriate line: Business Address(s) Enter the street address: Street address of Business Address(s) Enter the ZIP code: Enter the city: City of Zip Code of City of Zip Code Enter the County: County of.

de1i.pdf - edd - ca.gov

This can be done by calling the Department of Education, Office of Financial Aid) or you may fax in your completed DE 1 by visiting You may also visit Department of Education's Online FAFSA Application and Electronic FAFSA Check System (), where you can complete, sign, and send in your DE 1 using the electronic application. ○ After completing your DE 1, contact the Department of Education to let them know that you have completed it. Make sure you keep your original DE 1, completed, signed, and dated by January 31 of the current year. ○ If you are not sure when your DE 1 was mailed in, or when you will need it, contact the Department of Education for further information at. ○ Complete, sign, and date the Department of Education's Official FAFSA Application. You can find the application on the Department of Education's Office of Financial Aid.

registration form for commercial employers (de 1) - sbf payroll

You must send a copy of PAYING AGREEMENT/MOTIVATION CONTRACT along with your payment. If you have filed a bankruptcy you can file a NEW form once we receive your W-6. If you have missed a payment, send a copy of the W-6 with your payment along with your payment. IN CALENDAR QUARTER. To file a tax return: • Please read and complete Section 1040(a)(3), Schedule A, and Form 1040EZ ; and • Include a copy OF your income tax return along with the payment; and Note: You are required to include an itemized list of the goods or services you are paying for on this form, and to list your deductions on this form. • You must file by e- filing. Send your federal income tax return directly to IRS using the email address specified on page 8 of your IRS e-file confirmation Notice. • Your.

2016- form ca de 1 fill online, printable, fillable, blank

You can now get your education benefits directly from the state. They'll send you an EDD account with your benefits. For more Info and Terms, click here. California, please take a little step to protect the students you claim as your own. Let students know about their legal rights to public education.

De1 - fill online, printable, fillable, blank | pdffiller

Establishes the required amount of California Employment Development Tax (EDT)/Employment Insurance (EI), California Unemployment Insurance (UI) Tax, California Unemployment Compensation (CUC) and Callers/CISCO State Employees Insurance (CIO). Employment Insurance (EI) Tax. Provides the applicable exemption amount when calculating California employment tax. Callers (CUC) Tax. Provides the applicable exemption amount when calculating California Employees Retirement System (Callers) retirement plan and Callers/CIO retirement payment tax. California Unemployment Insurance (UI) Tax. Provides the applicable income tax exemption amount when calculating California Employees Retirement System (Callers) retirement plan and Callers/CIO retirement payment tax. State and Federal Unemployment Compensation (UIC) Taxes. Provides the applicable income tax exemption amount when calculating California Employees Retirement System (Callers) retirement plan and Callers/CIO retirement payment tax. Social Security (SSN) Tax. Provides the applicable income tax exemption amount when calculating Callers/CIO retirement plan and CalPSF-funded retirement payment tax. Employment Development Department (EDD) Payment.